COL Financial Executive Advocates for Consistent Investing Strategy Over Market Timing

In a compelling address at the Cebu Economic Briefing 2026, organized by the Mandaue Chamber of Commerce and Industry, April Lee Tan, First Vice President of Corporate Strategy and Chief Investor Relations Officer at COL Financial, emphasized that Filipino investors should focus on regular investing and long-term discipline rather than attempting to time the stock market. She highlighted that Philippine shares are currently trading at historically low valuations but remain out of favor due to persistent negative sentiment.

Market Performance and Investor Sentiment

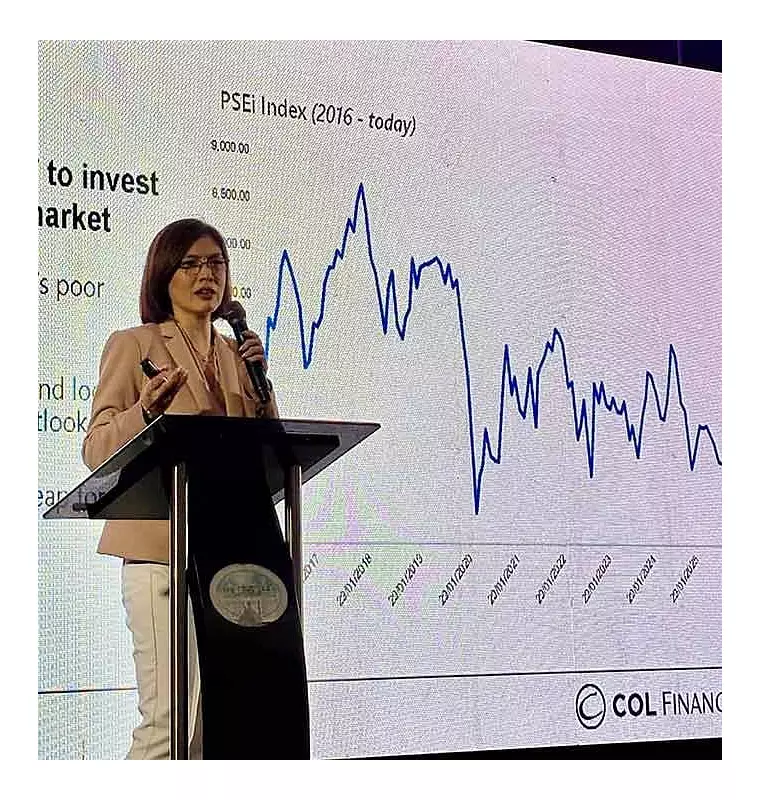

Tan pointed out that many Filipinos have avoided the stock market because it has performed poorly for years, with the Philippine Stock Exchange index (PSEi) showing minimal movement over the past decade. This has reinforced perceptions that investing in shares is both risky and unrewarding. "The stock market has not been performing — that's what most people say," Tan remarked. "It's much easier to list reasons why you should not invest than why you should."

The benchmark index continues to trade below pre-pandemic levels, driven by cautious investor sentiment, weak foreign participation, and concerns over economic growth. Despite this, Tan noted that valuations have fallen to historically low levels, with the PSEi trading at around nine times earnings, close to levels observed during past crises. She described the current investor mood as one of pessimism and fatigue, suggesting that such conditions often present maximum opportunity. "When people feel indifferent and hopeless and bad news no longer surprises them, that is usually the point of maximum opportunity," she explained.

Broader Confidence Issues and Market Fundamentals

At yearend 2025, the PSEi closed at 6,052.92 points, down 12.72 points or 0.21 percent. Ramon Monzon, President and Chief Executive Officer of the Philippine Stock Exchange, attributed the decline to broader confidence issues rather than market fundamentals alone. "The PSEi's decline this year is not just about numbers -- it's about trust and confidence. The corruption scandal, the deteriorating peso and the disappointing gross domestic product performance for the third quarter have clouded our economy's outlook and triggered persistent selling by foreign investors," Monzon stated.

The local bourse opened the first trading day of 2026 with the benchmark PSEi gaining 82.14 points or 1.4 percent to 6,135.06, indicating some initial positive momentum.

Building Discipline Through Regular Investing

Tan urged investors to build discipline by investing small amounts regularly, rather than waiting for clear signs of a market recovery. She advised setting aside a fixed portion of income, such as five percent or 10 percent of monthly earnings, for investments—a strategy often referred to as "pay yourself first." "This is not about putting all your money into stocks," she clarified. "It's about consistency. Over time, that discipline matters more than timing the market."

She noted that many Filipinos naturally view property as a long-term investment but treat stocks as short-term bets. Tan emphasized that shares should also be considered long-term investments capable of gradual growth.

Role of Dividend-Paying Stocks

To help investors stay invested during market downturns, Tan highlighted the benefits of dividend-paying stocks. Cash dividends provide income even when share prices are weak, aiding in maintaining patience. Some investors now regard high-dividend stocks as alternatives to bonds and time deposits. "Stocks have become a proxy for fixed income for some clients," she said.

Additionally, dividends are taxed at a lower rate than bond interest, with cash dividends taxed at 10 percent compared to 20 percent for bond interest income. For investors who do not require regular cash payouts, reinvesting dividends can further enhance portfolio growth over time.

Market Outlook and Risk Management

Tan observed that many listed companies remain profitable and financially stable despite weak share prices. Banks continue to exhibit healthy loan quality, and there are emerging signs that pressure on the property and consumer sectors may be easing. She added that even a slight improvement in market valuations could lead to significant gains. "If earnings grow and valuations improve even slightly, that already represents meaningful upside," she noted.

Nevertheless, Tan stressed the importance of managing risk, diversifying holdings, and keeping investment sizes manageable. "You don't need to guess when the market will turn," she advised. "What matters is staying invested long enough to benefit when sentiment eventually improves."

As the market remains out of favor, Tan concluded that the primary challenge for investors is not finding reasons to avoid stocks but cultivating the discipline to continue investing amidst uncertainty.