The Philippines' top finance super app, GCash, has rolled out two groundbreaking features designed to empower local entrepreneurs and the growing freelance community. The new offerings, PocketPay and the GCash Virtual US Account, aim to simplify financial transactions for businesses and gig workers across the nation.

PocketPay: Card Payments for MSMEs Made Simple

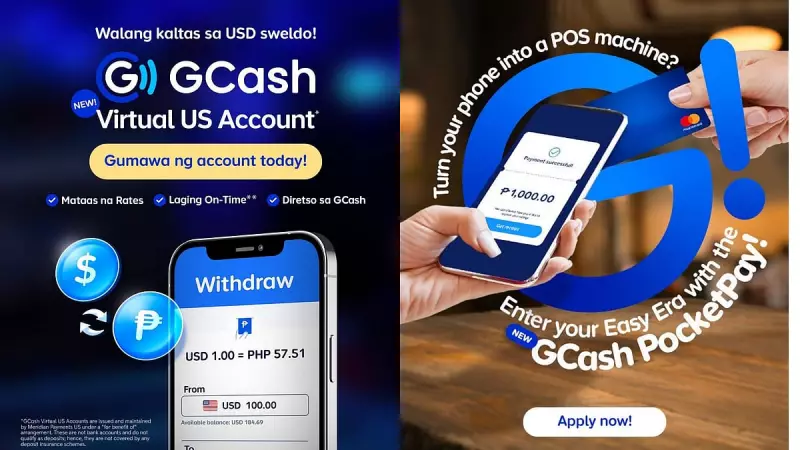

With the launch of PocketPay, micro, small, and medium enterprises (MSMEs) can now accept payments from debit and credit cards using just an Android smartphone. This tap-to-pay solution was developed in partnership with BPC, a global expert in payment systems.

This innovation is a game-changer for mobile sellers, delivery vendors, and pop-up merchants who operate outside traditional brick-and-mortar stores. It allows them to meet customer preferences for card payments without the need for expensive hardware. To encourage early adoption, GCash is offering zero transaction fees until December 3, 2025. Business owners can activate the feature through the GCash for Business portal.

"PocketPay makes accepting card payments available for all MSMEs. It's an easy-to-use and reliable business solution that meets their needs wherever they are," stated Jong Layug, GCash for Business Head.

GCash Virtual US Account: Faster, Cheaper Salaries for Freelancers

In a parallel move to support the digital workforce, GCash has introduced the GCash Virtual US Account. Powered by the global payments network Meridian, this feature is tailored for Filipino freelancers who have clients in the United States.

This account enables freelancers to receive payments from their US-based clients in real time, eliminating the typical one-to-three-day waiting period that can disrupt their daily budgeting. The service promises reduced platform fees and narrower foreign exchange spreads, meaning gig workers get to keep more of their hard-earned money. It also removes high withdrawal fees and hidden charges.

"With the GCash Virtual US Account, we're enabling Filipino freelancers to take full control of their hard-earned income, allowing them to receive payments seamlessly, cash out instantly, and keep every peso they have earned," explained Paul Albano, GCash General Manager for International.

Boosting Financial Inclusion and Dollar Inflows

The introduction of these two products reinforces GCash's mission to break down barriers to financial access. For small businesses, it means effortless card acceptance. For freelancers, it translates to faster and more affordable cross-border payments.

Furthermore, the GCash Virtual US Account is expected to increase dollar inflows into the Philippines. The United States is a top source of remittances for the country, with the Bangko Sentral ng Pilipinas reporting that about 40 percent of cash remittances from July to August this year originated from the US. This new feature provides a streamlined channel for these earnings, supporting both individual freelancers and the national economy.