Institutional Giants Tighten Grip on Bitcoin Market

The Bitcoin landscape is undergoing a dramatic transformation as major institutions accumulate staggering amounts of the digital currency. Currently, five prominent organizations collectively hold 798,000 BTC, representing nearly 3.8% of all Bitcoin in circulation.

Leading this institutional charge is Michael Saylor's MicroStrategy with 640,808 BTC, followed by MARA Holdings Inc. with 53,250 BTC. The consolidation trend accelerated recently when Strive became the first Bitcoin-focused treasury company to announce a merger, acquiring Semler Scientific in an all-stock deal.

The combined entity now controls 11,006 BTC, positioning it among the top twenty public Bitcoin holders worldwide. Other significant holders include Metaplanet Inc. and Bitcoin Standard Treasury Company.

The Challenge: Transforming Dormant Assets into Active Economy

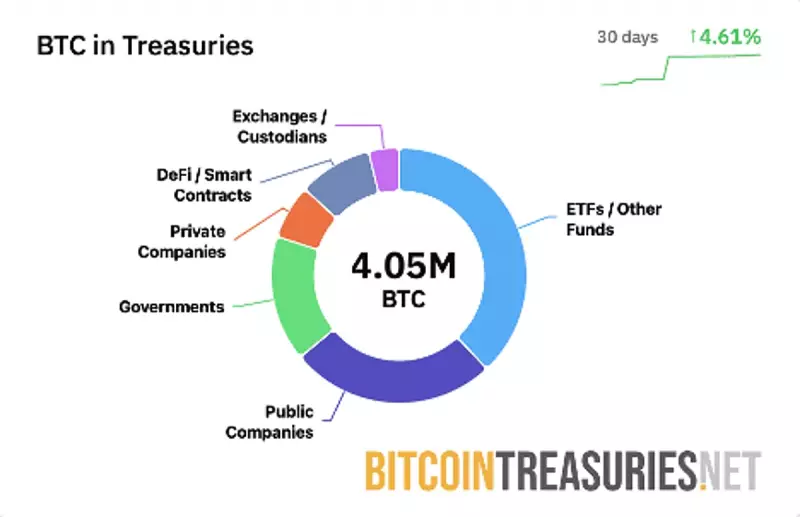

While institutional accumulation continues, a critical question emerges: what happens when these dormant assets reenter circulation? At current prices, the five largest institutions control approximately $87.55 billion worth of Bitcoin. When including other corporate holders, this figure climbs to 5.01% of total supply, valued at $115.6 billion.

An additional 7.14% of Bitcoin remains locked in ETFs, funds, and public reserves, with nearly 279,000 BTC tied up in DeFi protocols and smart contracts. This massive hoarding creates a scenario where a significant portion of Bitcoin remains frozen in cold storage, far from active market participation.

The fundamental challenge facing Bitcoin is its primary function as a store of value rather than a medium for everyday transactions. The original blockchain struggles with slow transaction speeds and high costs, making practical applications difficult to implement.

Bitcoin Hyper's Revolutionary Solution

Enter Bitcoin Hyper (HYPER), a project with an ambitious vision to bridge Bitcoin with Solana technology. The platform aims to become the first Layer 2 network to directly connect Bitcoin with Solana's infrastructure using the Solana Virtual Machine (SVM).

This technical innovation seeks to provide Bitcoin with what it has long lacked: quick, affordable, and frictionless applications. By leveraging Solana's speed while maintaining Bitcoin's legendary security, Bitcoin Hyper wants to transform BTC from a simple reserve asset into a thriving digital economy.

The platform's architecture utilizes a canonical bridge directly connected to Bitcoin, allowing developers to create applications on the original blockchain with Solana's performance characteristics. Every Bitcoin deposited into the Hyper ecosystem generates a wrapped equivalent that powers payments, exchanges, and various on-chain activities.

Gold vs Bitcoin: The Utility Gap

The comparison between gold and Bitcoin reveals a crucial distinction. Gold boasts a market capitalization of nearly $28 trillion, approximately fourteen times larger than Bitcoin's valuation. However, gold's value derives not just from scarcity but from its extensive utility across jewelry, industry, and cultural applications.

Bitcoin, meanwhile, must demonstrate it can evolve beyond being merely a store of value. While functioning effectively as digital gold that institutions accumulate and protect, it sees limited use in daily economic activities.

Bitcoin Hyper aims to address this gap by equipping the world's most famous cryptocurrency with tools to become more than just a reserve asset. The project emphasizes utility, innovation, and developer engagement to write a new chapter in Bitcoin's story.

As institutional holders continue their accumulation strategies, projects like Bitcoin Hyper work to unleash Bitcoin's latent potential. The goal is clear: transform idle Bitcoin into useful assets that can power a diverse range of decentralized applications and create a vibrant, living economy around the world's most valuable digital asset.