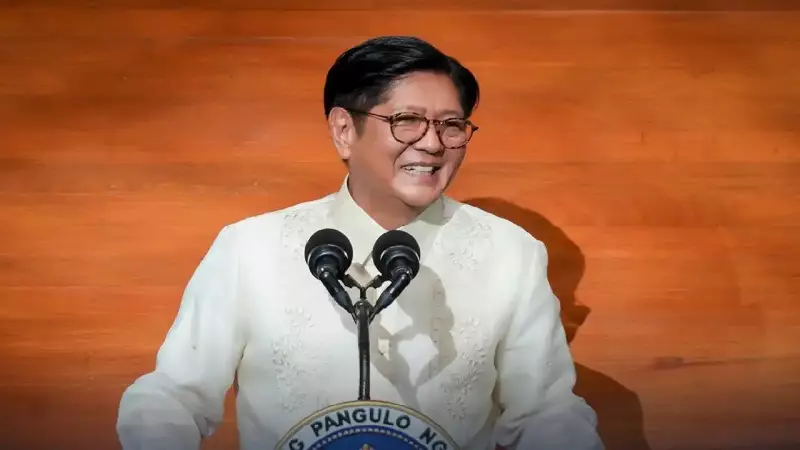

President Marcos Firmly Opposes P60 to $1 Exchange Rate, Palace Warns of Debt Consequences

President Ferdinand Marcos Jr. has made it clear that he will not accept the Philippine peso reaching an exchange rate of P60 to $1, according to a statement from the Palace. This stance comes amid growing concerns over the currency's volatility and its broader economic implications.

Palace Official Highlights Negative Impacts on National Debt

Palace Press Officer Undersecretary Claire Castro emphasized that allowing the peso to depreciate to such a level would have negative effects, particularly by increasing the country's debt burden. She explained that a weaker peso makes it more expensive for the Philippines to service its foreign-denominated obligations, potentially straining public finances.

Recent Meeting with BSP Officials to Address Currency Concerns

In response to these concerns, President Marcos recently convened a meeting with officials from the Bangko Sentral ng Pilipinas (BSP). The discussion focused on the peso's performance against the US dollar, exploring strategies to stabilize the currency and mitigate adverse economic impacts.

This meeting underscores the administration's proactive approach to managing exchange rate fluctuations and safeguarding the economy from external pressures.

Background on Recent Exchange Rate Highs

It is worth recalling that on January 15, the peso reached a record high of P59.46 to $1, highlighting the ongoing challenges in maintaining currency stability. This near-P60 threshold has prompted heightened vigilance from both the government and monetary authorities.

The administration's firm stance against further depreciation reflects a commitment to protecting the Philippine economy from potential inflationary pressures and increased debt costs.