Financial Literacy Bill Aims to Rescue Filipinos from Debt Cycle, Says Rep. Zubiri

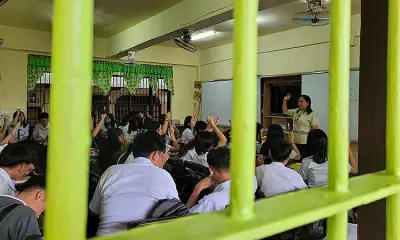

In a bold move to tackle the growing debt crisis among Filipinos, Bukidnon Representative Audrey Kay Zubiri has introduced a groundbreaking legislative proposal. The bill, known as House Bill No. 6091 or the Financial Education and Literacy Act, seeks to establish financial literacy as a core subject in both junior and senior high schools across the Philippines.

Addressing a National Crisis

According to Representative Zubiri, the primary goal of this initiative is to equip young Filipinos with essential skills in money management, saving, and debt avoidance. This comes as a direct response to the worsening problem of indebtedness that plagues a significant portion of the population. Zubiri emphasized that many Filipinos are drowning in debt not due to a lack of effort, but rather because of a critical gap in financial knowledge.

If immediate action is not taken, she warned, the next generation could be trapped in the same vicious cycle of debt, perpetuating economic hardship for years to come.

Alarming Statistics and Global Context

Supporting the urgency of this bill, data from the World Bank reveals that nearly half of all Filipinos rely on borrowing to meet their financial needs. This staggering statistic underscores the pressing need for early financial education. By introducing financial literacy at a young age, the legislation aims to reduce dependency on government assistance and foster responsible money management practices.

The proposed curriculum would cover topics such as budgeting, investment basics, and understanding credit, providing students with practical tools to navigate their financial futures.

Broader Implications for Society

The Financial Education and Literacy Act is not just an educational reform; it represents a strategic effort to enhance the overall economic resilience of the Philippines. By empowering youth with financial savvy, the bill hopes to:

- Decrease the national debt burden over time.

- Promote a culture of saving and prudent spending.

- Mitigate the risks associated with high-interest loans and predatory lending practices.

This legislative push aligns with global trends that recognize financial literacy as a cornerstone of personal and national prosperity. As the bill moves through the legislative process, stakeholders from the education and finance sectors are expected to weigh in on its implementation and potential impact.