Money sent by Filipinos working abroad continued its upward trend at the end of 2025, providing a significant boost to family budgets and national economic stability. Official data released by the Bangko Sentral ng Pilipinas (BSP) shows a steady increase in these crucial financial flows.

Steady Growth in Cash Inflows

According to the central bank, cash remittances channeled through banks reached $2.91 billion in November 2025. This figure represents a solid 3.6 percent increase from the $2.81 billion recorded in the same month of the previous year.

The positive trend held for the first eleven months of the year. From January to November 2025, total cash remittances climbed to $32.11 billion. This marks a 3.2 percent growth compared to the $31.11 billion inflows during the comparable period in 2024.

United States Leads as Primary Source

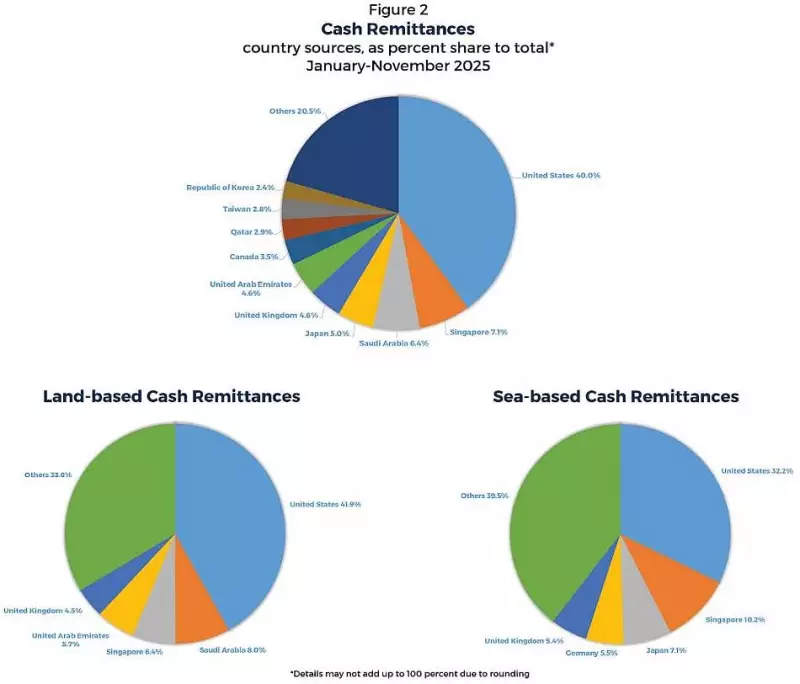

The geographic origins of these funds highlight the global footprint of the Filipino workforce. The United States solidified its position as the largest source of remittances, contributing a substantial 40 percent of the total inflows in the eleven-month period.

Other major contributing countries include:

- Singapore at 7.1 percent

- Saudi Arabia at 6.4 percent

- Japan, the United Kingdom, the United Arab Emirates, and Canada

The data shows that land-based overseas Filipino workers (OFWs) sent the majority of funds, with the U.S., Saudi Arabia, and Singapore as their top destinations. For sea-based workers, the United States was also the leading source, followed by Singapore and Japan.

Broader Personal Remittances Also Climb

The BSP also reported on the broader measure of personal remittances, which includes all transfers through formal and informal channels, as well as remittances in kind. This category rose to $3.23 billion in November 2025, up from $3.12 billion a year earlier.

For the cumulative January to November period, personal remittances totaled $35.73 billion, reflecting a 3.2 percent increase from the $34.61 billion recorded in 2024.

The central bank attributed the sustained growth to the stable demand for Filipino workers overseas and resilient labor markets in host countries, particularly in the United States and key regions in Asia and the Middle East.

Remittances remain a cornerstone of the Philippine economy, serving as a vital source of foreign exchange. These funds directly support millions of households, fueling consumption on essential needs like food, housing, education, and healthcare. Economists note that this steady inflow acts as a key economic buffer, helping to offset trade deficits and supporting domestic consumption amid ongoing global uncertainties.