The Mandaue City Government has officially started rolling out an increase in business taxes this 2026. This move follows a recently passed city ordinance that authorizes adjustments to local tax rates, a measure officials say is both regular and legally mandated.

A Scheduled and Legal Adjustment

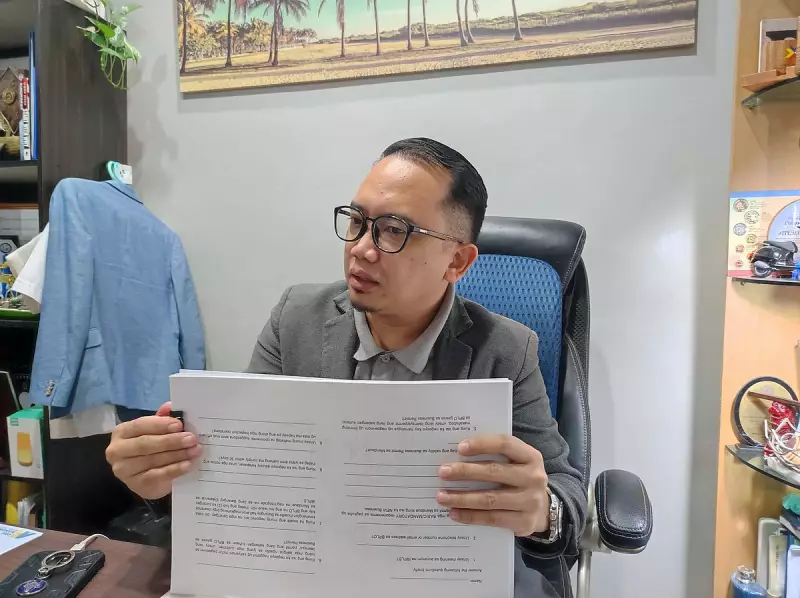

Lawyer August Lizer Malate, who leads the city's Business Permit and Licensing Office (BPLO), clarified that raising business tax rates, fees, and charges is a standard policy for Mandaue. He emphasized that the Local Government Code permits such adjustments.

"This is not an unprecedented move for Mandaue City," Malate stated. He explained that the law allows local government units to revise tax rates every five years, with the condition that any increase does not go beyond 10 percent.

Historical data supports this pattern, with similar increments applied in 2006, 2011, 2016, and 2021, consistently following the five-year cycle.

How the Increase Works: Rates, Not Flat Amounts

Malate provided crucial details on the mechanics of the hike. The adjustment applies to the tax rate itself, not a fixed sum added directly to a business's bill.

"To illustrate, if a business tax is calculated as one percent of gross sales, a 10 percent increase on that rate changes it to 1.1 percent," he said. "Similarly, if a specific fee is 100 pesos, a 10 percent rise makes it 110 pesos."

A Phased Approach for Business Relief

A key feature of the 2026 implementation is its staggered nature. Due to recent calamities affecting the area, Mayor Thadeo Jovito 'Jonkie' Ouano, upon the recommendation of the Local Finance Committee, proposed a gradual rollout.

"Rather than applying the full 10 percent increase in 2026, the city will implement only five percent this year," Malate confirmed. "The remaining five percent will take effect in 2027."

This phased strategy is designed to find a middle ground. It aims to support the city's revenue requirements while easing the potential burden on the local business community. Malate described it as a "win-win situation," noting that while the increase is legally required, spreading it over two years makes it more manageable for entrepreneurs.

City Councilor Attorney Joel Seno, chairperson of the Committee on Appropriation, Budget, and Finance, echoed this sentiment. He confirmed the ordinance was approved in the second week of December 2025 and took effect on January 1, 2026.

"Considering recent events that impacted Mandaue City and other parts of Cebu Province, we wanted to provide some relief to our business sector," Seno said. The councilor added that the decision helps prevent a negative ripple effect on consumer prices and employment levels.

Tax Still Tied to Sales Performance

Officials also stressed that the actual tax payment for each business will continue to depend on its declared gross sales. Businesses experiencing a downturn may consequently pay less.

"If business owners report lower sales, they must substantiate that declaration with proper documents," Malate advised. Acceptable proof includes Bureau of Internal Revenue reports, audited financial statements, and income tax returns.

Funding Essential Services Amid Inflation

The additional revenue generated from the tax adjustment is earmarked for strengthening the city's financial capacity. Malate pointed out that rising inflation has increased the costs of materials, labor, and equipment for public projects.

"The prices for service vehicles, construction supplies like cement and steel, and other operational expenses have gone up," he noted. "These revenue policies are essential to ensure we can continue delivering vital services and infrastructure projects to the public."

Councilor Seno concluded that the approach ensures businessmen are not overly burdened while allowing the city to comply with the law and generate necessary funds for essential services.