The Metropolitan Cebu Water District (MCWD) is actively courting private investors and bulk water suppliers in a major push to stabilize its finances, expand water supply, and halt years of operational losses.

Financial Strain and Open Invitation for Partnerships

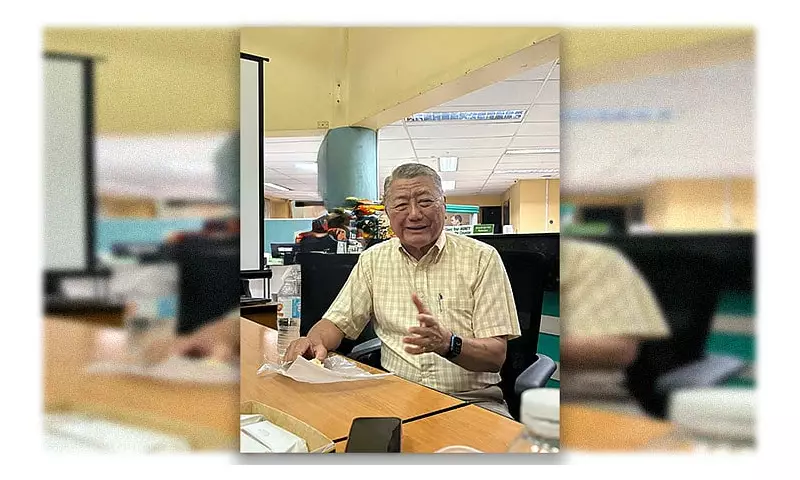

Ruben Almendras, the civic sector representative on the MCWD board, disclosed that the utility is burdened by heavy financial losses and a high non-revenue water (NRW) level. This situation has forced management to seek fresh capital, renegotiate current bulk water agreements, and pursue infrastructure partnerships, especially for crucial transmission lines.

"We are welcoming investors, including bulk water suppliers, who are willing to come in with competitive pricing and help us build the needed infrastructure," Almendras stated. He emphasized that private sector involvement is essential for turning the utility's performance around.

This call for investment follows expressed interest from Aboitiz InfraCapital Water. During the Cebu International Investment Summit 2026, company official Ramon Aboitiz Tuason highlighted a supply gap of about 300 million liters per day in Metro Cebu, underscoring the significant demand and investment opportunity.

Tackling High Costs and Infrastructure Gaps

A primary concern for MCWD is its high NRW, which measures water lost or unbilled. Although reduced from 39 percent in 2024, it remains at about 32 percent, far above the global benchmark of 18%. Almendras noted that every 10% reduction in NRW could generate roughly P500 million annually for the district.

Existing bulk water contracts also pose a financial challenge. Some suppliers charge up to P70 per cubic meter, which is higher than MCWD's average selling price to consumers. Currently, 52% of MCWD's supply comes from private producers, with 48% generated internally.

While new suppliers, including proponents of large-scale desalination plants, have shown interest, projects are often stalled due to a lack of transmission lines and right-of-way permits. "We have the supply potential, but without transmission infrastructure, we cannot fully utilize it," Almendras explained, urging investors to consider build-operate or build-transfer schemes for pipelines.

Path to Recovery: Rate Reforms and Two-Year Goal

To stem the financial bleed, MCWD is preparing to seek regulatory approval for a water rate adjustment and a shift to a progressive billing system. Under this system, higher water consumption would be charged at higher rates.

"The more you consume, the more you pay. That encourages conservation and makes the system fairer," Almendras said. He added that the current rate structure has been costing the utility hundreds of millions of pesos each year.

Discussions with regulators are anticipated in the coming weeks, with MCWD aiming for the earliest possible implementation of new rates once approved. Almendras believes that a combination of private investment, renegotiated bulk water prices, reduced NRW, and rate reforms could enable MCWD to recover financially within the next two years.

"This is not just about fixing MCWD. This is about ensuring sustainable, reliable water supply for Metro Cebu," he concluded.