As Filipinos approach their senior years, proactive planning becomes crucial for a secure and dignified future. A recent discussion emphasizes the importance of self-reliance and strategic preparation for those nearing senior citizenship, highlighting common pitfalls and offering actionable advice.

Financial Independence is Non-Negotiable

The core message is clear: start planning for old age while you are still young. This involves consistent saving, smart investing, and deciding on future living arrangements and livelihood options well before retirement age. Relying solely on children with an "ahala na akong anak nako" (my child will take care of me) mindset is not a viable plan. True love for your family means not burdening them with your old age.

While generosity is a virtue, it must have limits. Continuously giving financial help to family and friends can deplete resources needed for your own future. It is important to set boundaries on lending and prioritize setting aside funds for your own security. Remember, there is no guarantee that kindness will be reciprocated when you are in need.

Navigating Changing Family Dynamics

A critical piece of advice is to manage expectations regarding adult children. Do not rely entirely on your children for support. As they marry and start their own families, their priorities will naturally shift. This change is a normal part of their maturation and should not be taken personally or as a source of bitterness.

If they offer help, consider it a blessing, not an obligation. Do not force them to repay you for the sacrifices you made when they were young. Ensure you can live independently, even if you sometimes disagree with in-laws, so your well-being is not contingent on their assistance.

Prioritizing Health is the Best Investment

One of the most cost-effective strategies for aging well is to take meticulous care of your health now. Preventing illness is far cheaper than treating it. The costs of medication and hospital bills in old age can be staggering, especially when health insurance becomes difficult or impossible to obtain.

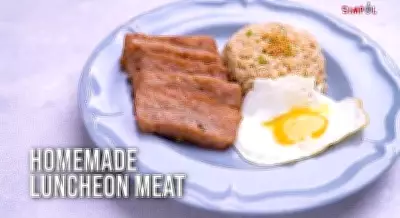

To avoid becoming a physical and financial burden, adopt a healthy lifestyle. Eat plenty of fresh vegetables and root crops, exercise regularly, and get sufficient sleep. Investing in supplements or vitamins today is more economical than dealing with major health issues tomorrow.

Ultimately, the path to a peaceful retirement in the Philippines requires a blend of financial foresight, emotional independence from children, and unwavering commitment to personal health. By taking these steps early, Filipinos can ensure their golden years are marked by dignity and security, not hardship.