Success doesn't arrive by chance—it emerges from the conscious, intelligent decisions you make daily. When planning your future in the Philippines, the choices surrounding your money carry more weight than almost any others.

The Foundation of Financial Freedom

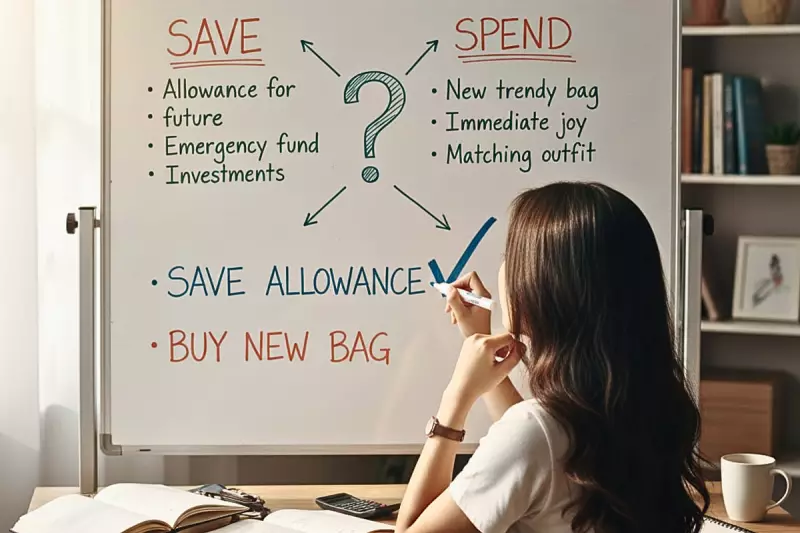

Every peso you save, spend, or invest directly shapes the life you will lead. Poor financial choices can trap you in debt and stress, while smart decisions unlock opportunities for freedom, expanded options, and greater peace of mind.

Think of your financial decisions as building blocks. Each one supports a specific life goal: graduating from college, starting a business, buying your dream home, traveling extensively, or even achieving early retirement. The habit of saving and spending wisely might seem insignificant today, but it forms the essential foundation for lasting success.

Developing Smart Money Habits

You don't need to be a financial expert to manage your money effectively—you simply need to stay informed. Understanding basic money management gives you control and helps you recognize opportunities rather than miss them. The crucial step is developing these smart financial habits early and consistently.

Begin by setting clear financial goals and understanding exactly what you're saving for. Don't hesitate to ask questions and explore all your available options. Before making any purchase, carefully weigh the rewards against your priorities. Commit to continuous learning by staying updated on financial information. When facing difficult decisions, always return to your core goals for guidance.

PDIC: Your Financial Safety Net

Choosing to save with a bank represents one of the most solid financial decisions you can make. Not only does it provide safety and security for your funds, but it also comes with crucial protection through the Philippine Deposit Insurance Corporation (PDIC). This government instrumentality safeguards depositors and promotes financial stability across the banking system.

Through PDIC protection, bank deposits are insured up to ₱1 million per depositor, per bank. Maintaining bank deposits not only helps you prepare for emergencies and major life goals but also builds the essential discipline of regular saving. Essentially, keeping your money secure in the bank means keeping your dreams and aspirations protected as well.

As motivational speaker Tony Robbins wisely noted: "It is in your moments of decision that your destiny is shaped." There's no better time to begin your financial education journey than during the observance of Economic and Financial Literacy Week. Start learning, saving, and making intelligent choices that actively support your ambitions.

Your future isn't something that will simply happen to you—it's something you must consciously create through deliberate action and informed financial decisions today.