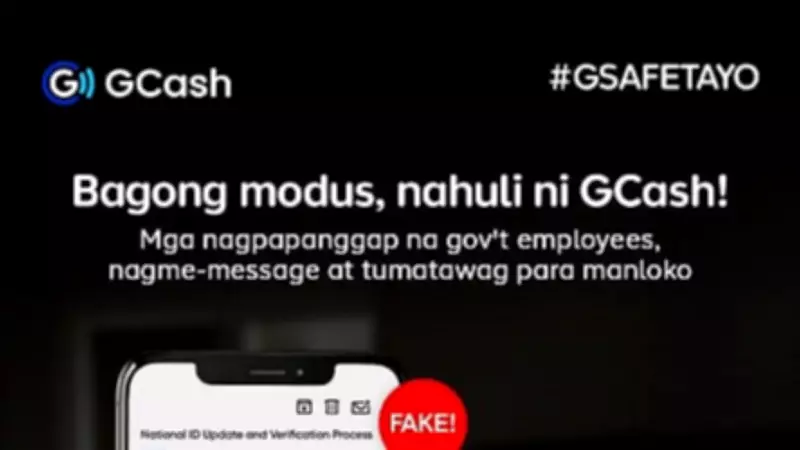

GCash Issues Critical Alert on Evolving Digital Scam Tactics Targeting Filipino Users

GCash, the Philippines' leading mobile wallet service, has issued an urgent public warning about increasingly sophisticated scam tactics that are putting users' financial security at risk. Fraudsters are now employing advanced methods to impersonate legitimate organizations and government agencies, creating a growing threat to digital banking and e-wallet security across the nation.

Sophisticated Scam Methods Employed by Cybercriminals

According to the latest security advisory from GCash, scammers have developed multiple deceptive approaches to target unsuspecting victims. These criminals are utilizing a combination of communication channels including phone calls, emails, fake mobile applications, and even staged online video meetings to pressure individuals into revealing sensitive account information.

The primary objective of these scams remains consistent: to obtain victims' account credentials, leading to unauthorized access and significant financial losses. What makes these new tactics particularly dangerous is their level of sophistication and the psychological pressure tactics employed by fraudsters.

Two Major Scam Categories Identified

Fake Government and eGovPH Representatives

One prominent scam method involves fraudsters posing as representatives from legitimate companies or government agencies, particularly targeting the Philippine Identification System (PhilSys). These scammers typically contact victims claiming that their National ID is ready for collection or requires immediate verification.

The fraudulent process typically unfolds through these steps:

- Scammers initiate contact and create a sense of urgency regarding National ID verification

- They request victims to join a Google Meet call or similar video conference platform

- During the call, they send suspicious links and pressure victims to download fake applications

- They ask victims to share their screens during the process

- By observing screen activity, scammers steal one-time passwords (OTPs), MPINs, and other login credentials

- With this information, they gain unauthorized access to banking and e-wallet accounts

Fake Promotions and Too-Good-to-Be-True Offers

Another prevalent scam category involves fraudulent promotions and rewards schemes. Scammers impersonate customer service representatives or company officials, contacting users about supposedly expiring rewards, special points promotions, or limited-time offers.

These scams typically feature:

- Creation of artificial urgency to pressure quick decisions

- Claims that an OTP is required to redeem offers or secure rewards

- Impersonation of GCash or bank representatives offering account verification services

- Promises of cashback rewards or security updates that require immediate action

Essential Protective Measures for GCash Users

GCash has outlined several critical protective measures that users should implement immediately:

Immediate Actions to Take

- Ignore unexpected calls or meeting invitations regarding account or ID verification

- If pressured to act quickly, immediately hang up or decline the invitation

- Never share your OTP, MPIN, passwords, or screen during any login or transaction process

- Avoid downloading applications from links sent via email or text message

- Only download official applications from verified sources: Apple App Store, Google Play Store, or Huawei AppGallery

Reporting Suspicious Activity and Staying Informed

GCash emphasizes the importance of reporting any suspicious activity immediately. Users can report suspected scams through multiple channels:

GCash Official Reporting Channels

- Access the GCash Help Center at help.gcash.com

- Chat with Gigi, the virtual assistant, and select "I want to report a scam"

- Call the official GCash hotline at 2882

Law Enforcement Reporting Options

- Philippine National Police Anti-Cybercrime Group: (02) 8414-1560 or 0998-598-8116

- Email: acg@pnp.gov.ph

- Cybercrime Investigation and Coordinating Center (CICC) Hotline: 1326

- CICC Mobile: 0991-481-4225

- CICC Email: report@cicc.gov.ph

GCash's Ongoing Security Initiatives

GCash maintains an active security monitoring system that continuously works to protect users. The company's security team regularly:

- Monitors and blocks suspicious account activity

- Takes down reported scam links and fraudulent accounts

- Collaborates closely with law enforcement agencies

- Works with government partners to enhance public protection

- Develops new security features and educational resources

The company reminds users that legitimate GCash representatives will never pressure customers for immediate action, request screen sharing during transactions, or ask for OTPs and passwords through unsolicited communications. Staying vigilant and informed remains the best defense against evolving digital threats in the Philippine financial landscape.