In a significant move to boost the national housing agenda, the Philippine government has approved increased price ceilings for socialized subdivision and condominium projects. This adjustment, announced on January 6, 2026, aims to align project costs with current economic realities while the Pag-IBIG Fund reaffirms its commitment to providing affordable financing.

Updated Price Caps Reflect Current Construction Costs

The new maximum selling prices were established under the Joint Memorandum Circular No. 2025-001 issued by the Department of Human Settlements and Urban Development (DHSUD) and the Department of Economy, Planning, and Development (DEPDev). DHSUD Secretary Jose Ramon Aliling emphasized that the update ensures Filipino workers can access safe, decent, and durable homes that remain affordable.

Aliling explained that revising the ceilings allows developers to cover prevailing construction expenses, enabling them to sustain operations and, crucially, improve the quality and safety standards of socialized housing units. This step is seen as vital for strengthening the industry's capacity to deliver homes at scale.

New Price Ceilings and Specifics

The implementing rules and regulations (IRR) specify the following new limits:

- For socialized house and lot units: PHP 844,440 for a minimum size of 24-26 square meters, and PHP 950,000 for units measuring 27 square meters and above.

- For socialized condominium projects: Prices are adjusted based on building height and unit size. The maximum selling price is set at up to PHP 1.8 million for projects above five floors with units of 27 square meters and above.

A notable provision allows for an additional charge of up to PHP 200,000 based on zonal value for eligible projects in the National Capital Region and other highly urbanized cities. This brings the total allowable maximum selling price for select categories to PHP 2 million.

Pag-IBIG Fund's Sustained Support with Subsidized Rates

Parallel to the price adjustments, the Pag-IBIG Fund has pledged to continue its support for the Expanded Pambansang Pabahay para sa Pilipino (4PH) Program. Pag-IBIG Fund Chief Executive Officer Marilene Acosta stated that the Fund's strong fiscal position allows it to maintain its offer of subsidized housing loan rates, aligning with the Marcos administration's goal of expanding homeownership access.

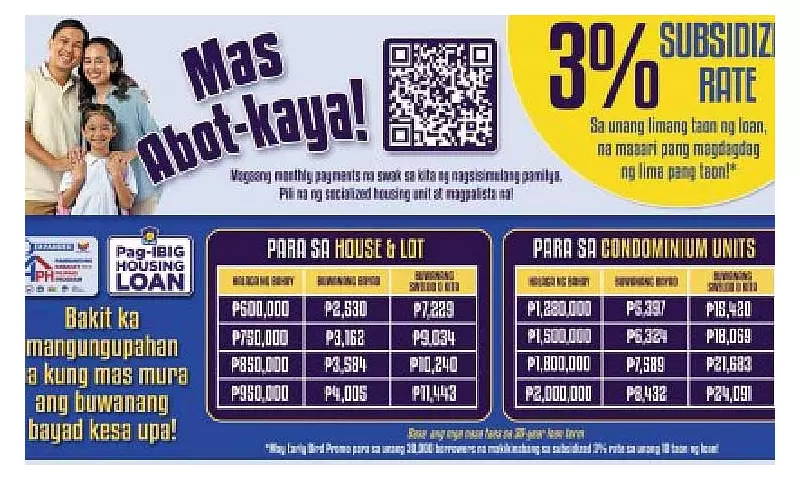

Under the Pag-IBIG Housing Loan for the Expanded 4PH, qualified members can avail of loans at a subsidized interest rate of 3% for the first five years, with an option to extend for another five years for eligible borrowers.

This translates to manageable monthly amortizations:

- Approximately PHP 4,005 for house and lot units priced up to PHP 950,000.

- Around PHP 8,432 for condominium units priced up to PHP 2 million.

Furthermore, through the "Early Bird" promotion, the first 30,000 qualified borrowers can enjoy the 3% interest rate for the entire first 10 years of their loan term.

Accelerating Housing Production

Acosta added that the Pag-IBIG Fund will collaborate closely with housing stakeholders, including partner developers, to accelerate the production of housing units and facilitate loan takeouts under the program. This integrated approach between policy adjustment (price ceilings) and sustained financial support (subsidized loans) is designed to create a more robust and responsive housing ecosystem for ordinary Filipinos.