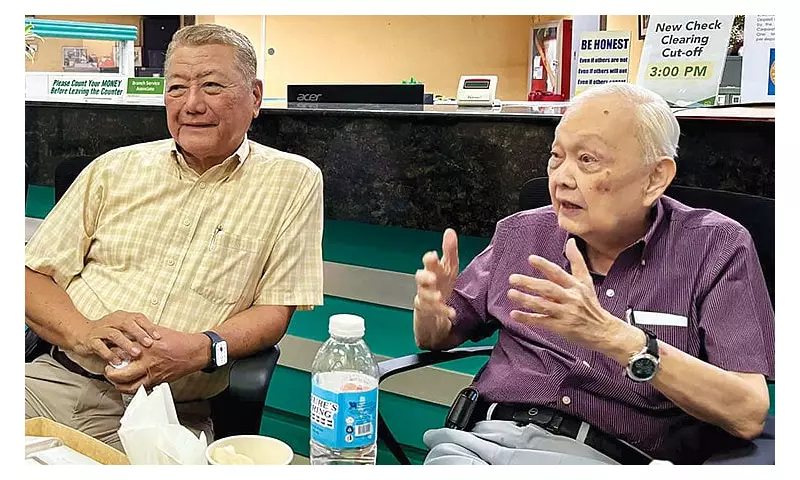

Cebu International Financial Corp. (CIFC) has made a significant move to bolster financial services for small businesses in the Visayas by investing P200 million into Aspac Rural Bank. The capital infusion, announced jointly by CIFC president Ruben Almendras and Aspac chairman emeritus Augusto Go on January 15, 2026, is set to dramatically increase the community bank's lending capacity.

Strengthening Grassroots Finance for MSMEs

The primary beneficiaries of this strategic investment are expected to be micro, small, and medium enterprises (MSMEs), which form the backbone of the regional economy. Aspac Rural Bank has historically focused on this sector, with small traders, professionals, and medium-sized enterprises comprising about 60 percent of its borrower base.

"We have always been heavy on small and medium-scale enterprises," said Augusto Go. He emphasized the critical role rural banks play in providing grassroots financing, especially in areas outside major metropolitan centers where larger commercial banks often impose stricter requirements that limit access for local entrepreneurs.

Capital for Growth and Digital Transformation

Ruben Almendras, CIFC's president and CEO, explained that the fresh capital will solidify Aspac's financial foundation. This will enable the bank to expand its lending portfolio, accelerate loan processing times, and significantly upgrade its digital banking infrastructure. CIFC, a private equity and investment firm with banking and property interests, is uniquely positioned as one of the few finance companies with a quasi-banking license from the Bangko Sentral ng Pilipinas that is headquartered outside Metro Manila.

"We are a private equity investor," Almendras stated. "We look for profitable banks where we can put in capital, improve operations and grow with them." This investment aligns with CIFC's strategy of acquiring stakes in well-managed banking institutions with clear potential for expansion.

A Hybrid Banking Model for the Future

Aspac Rural Bank president and CEO Jose Levi Villanueva detailed how the funds will be used to push forward a hybrid banking model, which blends physical branch networks with advanced digital services. The bank is already part of a select group of rural banks nationwide capable of real-time, inter-branch transactions and mobile-based services.

Concrete plans include opening two new branches in southern locations and a greater reliance on technology to deliver full services without the high costs of traditional expansion. A key upcoming initiative is the launch of a digital wallet with no minimum balance requirement, targeting students, families, and small entrepreneurs who need fast and affordable financial tools.

"This investment means more capital, more branches and faster growth," Go affirmed. "It allows us to move to the next stage of development." Almendras concluded that the ultimate goal is broader financial inclusion, stating, "With stronger capital and better technology, we can lend more, lend faster, and manage risk better. That’s where MSMEs stand to gain the most."