Philippine Banking Sector Maintains Strong Growth Trajectory

The Bangko Sentral ng Pilipinas (BSP) has reported a period of sustained expansion and resilience for the country's banking industry during the first half of 2025. The central bank's latest assessment reveals broad-based growth across key metrics, underscoring the system's fundamental strength.

Robust Asset Growth and Profitability

According to the BSP's Report on the Philippine Financial System for the First Semester of 2025, the total assets of the banking sector reached an impressive ₱28.2 trillion as of June 2025. This figure represents a substantial year-on-year growth of 7.7 percent, fueled primarily by stable domestic deposits. The sector also maintained strong liquidity and capital buffers, providing a solid foundation for this expansion.

On the profitability front, the industry demonstrated sound health with net income rising to ₱198.1 billion for the period ending June 2025. This marks a 4.1 percent increase compared to the same period last year. The BSP attributed this positive performance to the banks' prudent risk management practices and effective credit governance.

Strategic Initiatives for a Resilient Future

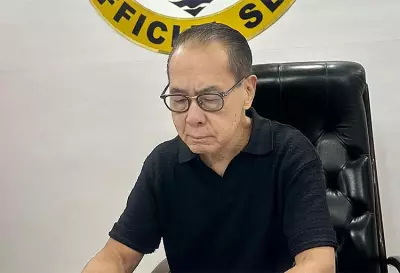

BSP Governor Eli M. Remolona, Jr. emphasized that the system's solid performance highlights its capacity to seize opportunities while navigating potential risks. He stated, "The banking system’s solid performance underscores its strength in seizing opportunities, navigating emerging risks, driving innovation, and championing inclusive and sustainable growth."

Governor Remolona further confirmed that the BSP will continue to implement policies designed to fortify the banking system. These efforts aim to create an environment where banks can continue to grow, support broader economic activity, and adapt to the evolving needs of Filipino consumers and businesses.

The report also highlighted several key strategic initiatives the BSP is pursuing in collaboration with financial institutions and other regulators. These include:

- Enhancements to the national credit information system.

- Significant improvements in the anti-money laundering and counter-terrorism financing framework.

- The promotion of a more inclusive and digitally-accessible retirement savings account system.

- The establishment of a new Financial Cyber Resilience Governing Council to address digital security threats.

These comprehensive measures reflect the BSP's commitment to proactive oversight and close coordination with its supervised entities to further boost the long-term resilience of the Philippine financial system.