The Philippine banking industry demonstrated remarkable strength and continued expansion during the first six months of 2025, according to the latest report from the Bangko Sentral ng Pilipinas (BSP).

Strong Financial Performance Indicators

Data released on Friday, November 7, 2025, revealed that the country's banking system maintained its growth trajectory with total assets increasing by 7.7 percent year-on-year to reach P28.2 trillion as of end-June 2025. This substantial growth was primarily fueled by stable domestic deposits and supported by sufficient liquidity and capital reserves.

The central bank's Report on the Philippine Financial System for the First Semester of 2025 indicated that loans and investments constituted the majority of total assets, while the overall quality of these assets remained at satisfactory levels. The sector's profitability also showed positive momentum, with net profit climbing 4.1 percent to P198.1 billion compared to the same period last year.

Regulatory Confidence and Strategic Direction

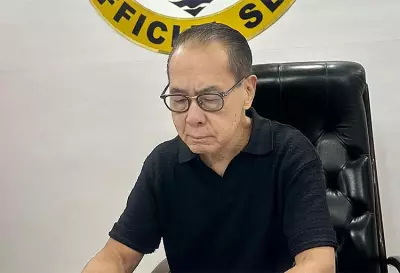

BSP Governor Eli M. Remolona Jr. emphasized that the banking system's solid performance reflects its capacity to capitalize on opportunities while effectively managing emerging risks. "The banking system's solid performance underscores its strength in seizing opportunities, navigating emerging risks, driving innovation, and championing inclusive and sustainable growth," Remolona stated.

The central bank chief further committed to continuing policies that would "further strengthen the banking system" and establish conditions for financial institutions to "keep growing, support economic activity, and meet the evolving needs of Filipinos."

Enhanced Financial Security Measures

The report highlighted several key initiatives that contributed to the sector's resilience. Foreign currency deposit units and trust entities delivered robust performances, while significant progress was made in improving the country's credit information system.

Notable developments included:

- Strengthening of anti-money laundering and counterterrorism financing frameworks

- Promotion of digitalized retirement savings systems

- Establishment of a Financial Cyber Resilience Governing Council

The newly formed council aims to improve coordination among regulators and industry participants in protecting the financial system against increasing cyber threats. These comprehensive reforms demonstrate the BSP's ongoing collaboration with supervised financial institutions, regulators, and industry associations to enhance both the resilience and inclusiveness of the Philippine banking system.