Interest Rate Decline Set to Boost Philippine Lending and Economy

The Philippine economy is poised to receive a significant boost as domestic interest rates continue to fall, encouraging a rise in lending activities. This trend is expected to underpin the sustained resilience of the nation's economic expansion, according to financial experts.

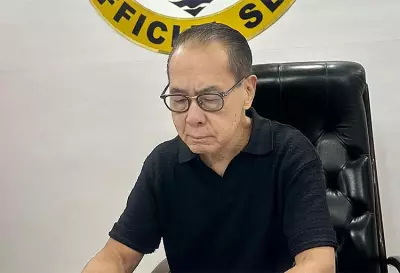

Economist Points to BSP Rate Cuts as Key Driver

Michael Ricafort, the chief economist at Rizal Commercial Banking Corp. (RCBC), explained to the Philippine News Agency that the series of interest rate reductions implemented by the Bangko Sentral ng Pilipinas (BSP) is a primary factor. The BSP has cut rates by a total of 100 basis points so far this year, a move that is anticipated to make bank loans more attractive for businesses seeking to fund their expansion plans.

Recent data released by the BSP on November 5, 2025, provides a snapshot of the current lending landscape. In September, bank lending, excluding placements in the BSP's reverse repurchase facility, grew by 10.5 percent on an annual basis. While this indicates healthy growth, it represents a slowdown from the 11.2 percent recorded in August.

Ricafort noted that this is the slowest growth rate in 14 months, dating back to July 2024. He attributed the deceleration partly to weather-related disruptions that hampered business transactions and economic activities, alongside a decline in infrastructure-related spending.

Breaking Down the Loan Growth Figures

A closer look at the BSP data reveals the performance of different loan segments. Loans for businesses increased by 9.1 percent in September, down from 9.9 percent in August. Meanwhile, consumer loans maintained a strong pace, growing by 23.5 percent, though slightly slower than the previous month's 23.9 percent.

Despite this modest slowdown, Ricafort emphasized a highly positive outlook. Large bank loans growth is still considered among the fastest in more than 2.5 years, or since December 2022, he stated. He described the steady expansion of bank lending as a bright spot and a key growth driver for the Philippine economy.

This strength is partly fueled by the country's favorable demographics. With an average age of 25 for its 114 million population, the demand for consumer finance is naturally high. Ricafort highlighted that the consumer loans-to-GDP ratio in the Philippines, which stands at just over 11 percent, remains lower than in many more developed ASEAN countries, indicating significant room for future growth in this sector.

RRR Cuts Inject Billions into the Financial System

Another critical factor supporting the lending environment is the reduction in the reserve requirement ratio (RRR) for banks. Ricafort pointed out that the 250 basis points cut in the RRR for universal and commercial banks in September 2024 alone was estimated to have infused approximately PHP 400 billion into the domestic financial system.

These RRR cuts effectively increase the funds that banks have available for lending, while also reducing intermediation and borrowing costs, he explained. This stimulates demand for loans and credit, which in turn boosts economic growth and investment valuations. He concluded that such monetary easing measures are sustainable as long as inflation remains well within the central bank's target range.